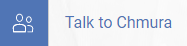

Job ads have plummeted in the United States over the past several weeks due to the coronavirus outbreak. Trends, however, are pointing to areas of growth in the economy as well as areas of high stress.

From the week of March 2 to March 9, ad volume in the United States declined 12%. The following week of March 16 saw a further drop of 31%. As detailed below, this contraction has largely been across the board, though with some exceptions.

Occupation Trends

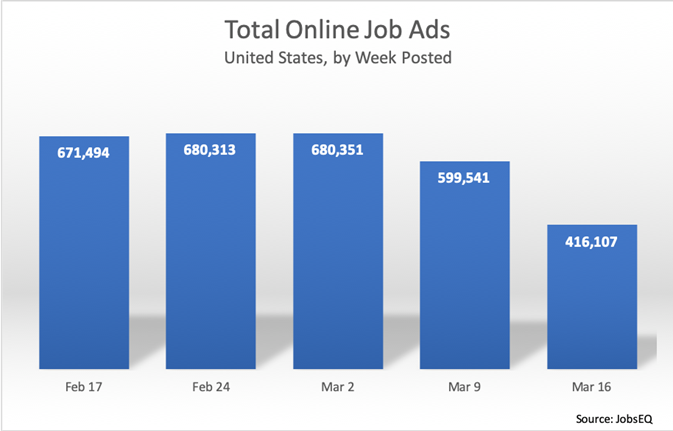

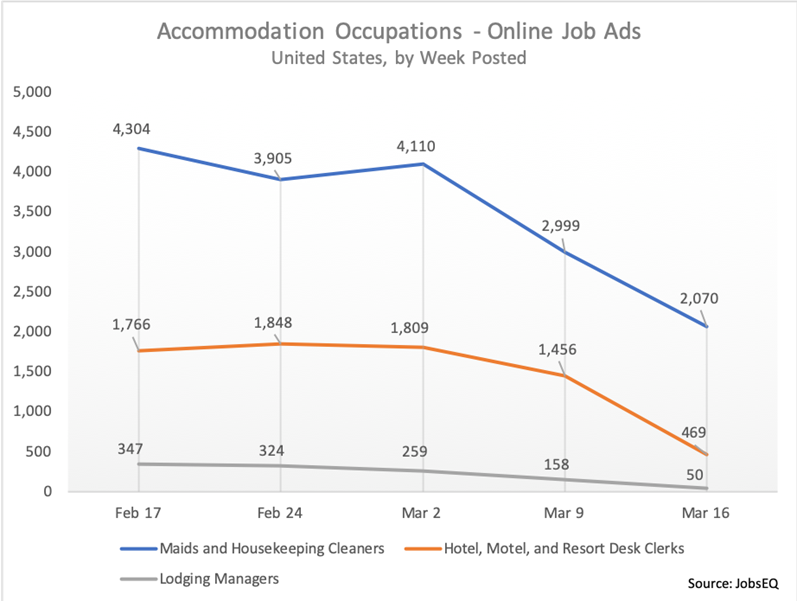

As pointed out last week, both the accommodation and food services industries are sustaining job losses that are being accompanied by sharp declines in new job postings.

The declines in ads among common hotel and lodging occupations has been pronounced over the last two weeks. Online ads for maids and housekeeping cleaners dropped by close to half over the last two weeks while hotel, motel, and resort desk clerks contracted nearly three-quarters.

The declines among food service occupations have also been steep. Job postings for waiters and waitresses, for example, plummeted 87% over the last two weeks from 5,642 the week of March 2 to 726 the week of March 16.

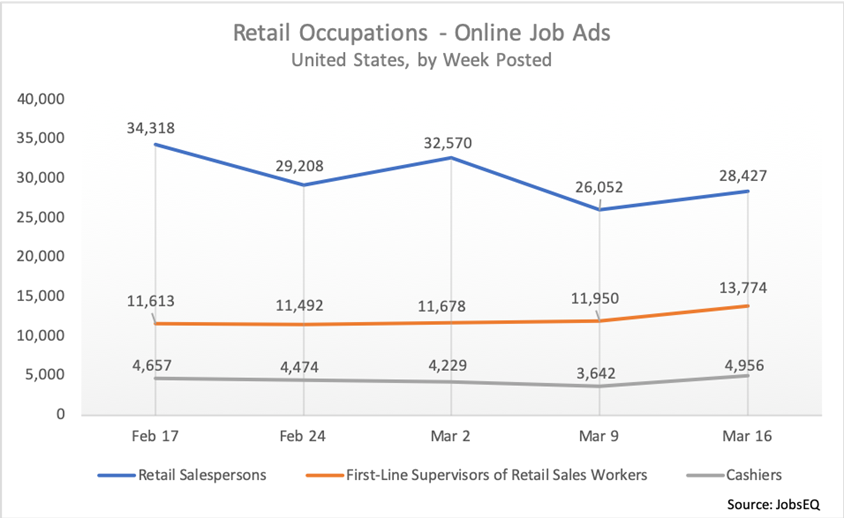

While some retail jobs showed declines the week of March 9, these jobs expanded last week. Retail salespersons, first-line supervisors of retail sales workers, and cashiers all saw increases in job ads the week of March 16. Walmart, CVS, Kroger, and Dollar General, for example, are among retailers that have begun massive hiring efforts to accommodate shifting demand. Other retail jobs that have had job ad increases include stock clerks and order fillers.

Online Job Ads, United States by Week Posted

| SOC Major Occupation Groups |

Feb 17 |

Feb 24 |

Mar 2 |

Mar 9 |

Mar 16 |

4-Week % Change |

| Management |

49,996 |

53,231 |

49,065 |

47,985 |

30,778 |

-38% |

| Business and Financial Operations |

42,917 |

46,080 |

44,294 |

41,244 |

26,299 |

-39% |

| Computer and Mathematical |

60,074 |

88,072 |

72,293 |

63,749 |

48,926 |

-19% |

| Architecture and Engineering |

13,328 |

12,425 |

12,592 |

11,458 |

7,420 |

-44% |

| Life, Physical, and Social Science |

7,378 |

7,777 |

7,194 |

6,351 |

4,553 |

-38% |

| Community and Social Service |

20,287 |

17,331 |

17,387 |

15,846 |

10,672 |

-47% |

| Legal |

3,638 |

3,572 |

3,429 |

4,034 |

1,610 |

-56% |

| Education, Training, and Library |

16,721 |

17,781 |

17,911 |

18,838 |

9,457 |

-43% |

| Arts, Design, Entertainment, Sports, and Media |

11,401 |

10,557 |

10,818 |

11,990 |

6,001 |

-47% |

| Healthcare Practitioners and Technical |

69,880 |

59,928 |

61,152 |

58,930 |

41,863 |

-40% |

| Healthcare Support |

20,745 |

18,186 |

18,199 |

16,522 |

12,704 |

-39% |

| Protective Service |

9,258 |

8,371 |

8,759 |

7,265 |

5,986 |

-35% |

| Food Preparation and Serving Related |

46,794 |

44,301 |

49,580 |

37,335 |

19,993 |

-57% |

| Building and Grounds Cleaning and Maintenance |

18,780 |

19,679 |

18,324 |

16,876 |

10,629 |

-43% |

| Personal Care and Service |

14,880 |

19,811 |

14,353 |

12,702 |

7,699 |

-48% |

| Sales and Related |

88,942 |

77,731 |

81,520 |

70,544 |

68,093 |

-23% |

| Office and Administrative Support |

74,741 |

74,119 |

74,983 |

70,112 |

43,891 |

-41% |

| Farming, Fishing, and Forestry |

439 |

460 |

512 |

379 |

306 |

-30% |

| Construction and Extraction |

12,432 |

12,917 |

14,418 |

10,996 |

5,733 |

-54% |

| Installation, Maintenance, and Repair |

27,957 |

23,947 |

23,842 |

20,546 |

13,573 |

-51% |

| Production |

20,193 |

18,281 |

18,142 |

16,890 |

10,782 |

-47% |

| Transportation and Material Moving |

40,713 |

45,756 |

61,584 |

38,949 |

29,139 |

-28% |

| Source: JobsEQ |

Despite a smattering of increases among detailed occupations, every major occupation group posted declines in job ads over the past four weeks. These changes varied from a 19% drop among computer and mathematical occupations to a 57% contraction in the food preparation and serving related group.

These universal declines raise the question of what long-term impacts the COVID-19 outbreak will have on the economy. Among companies postponing hiring efforts, for example, to what extent will these businesses accelerate hiring following a return to normalcy to make up for lack of hiring during the crisis? Alternatively, how many of these potential job gains will be permanently delayed?

About the Data

All data above are derived from JobsEQ, the Real-Time Intelligence online job ad data set, pulled from over 30,000 websites and updated daily. Each week of ads is defined as new online ads that start between Monday and the following Sunday, inclusive. All ad counts represent deduplicated figures. The relationship between ad counts and actual hires is described here.

Many extraneous factors can affect short-term volume of online job postings. Thus, while the changes noted above should be watched over time to confirm the impacts, such a short-term snapshot can offer an early indication of labor market shifts, especially valuable in this time of unprecedented economic disruption.