The current U.S. unemployment rate, which has been decreasing for over the last nine years, is at 3.7% as of July 2019, up 0.1 percentage point from June when it was at a near 50-year low. This has some asking, “How low can the unemployment rate go?” The best insight into this question may come from considering economic theory, analyzing historical trends, and tracking Federal Reserve policy.

The first necessary concept to understand when approaching this question is the “Natural Rate of Unemployment.” This theoretical rate is one which occurs “naturally” due to frictional and structural unemployment.[1],[2] Because of these two types of unemployment, the unemployment rate can never be 0%—there will always be some people temporarily unemployed for various reasons. At the natural rate of unemployment, the labor market is theoretically at “equilibrium,” meaning there is no natural market force pushing unemployment up or down.[3] The term “Natural Rate of Unemployment” is often used interchangeably with the term “full employment.” However, the wording of full employment can prove deceptive to those who are unfamiliar with economic jargon. For example, one who sees “full employment” might guess this indicates an economy in which everyone is employed and there is a 0% unemployment rate. However, “full employment” is just another way to describe an economy with an unemployment rate equal to the Natural Rate of Unemployment. Also important to note is the fact that the Natural Rate of Unemployment is an estimate. No one knows for sure exactly what value this rate equals and how it changes over time.[4]

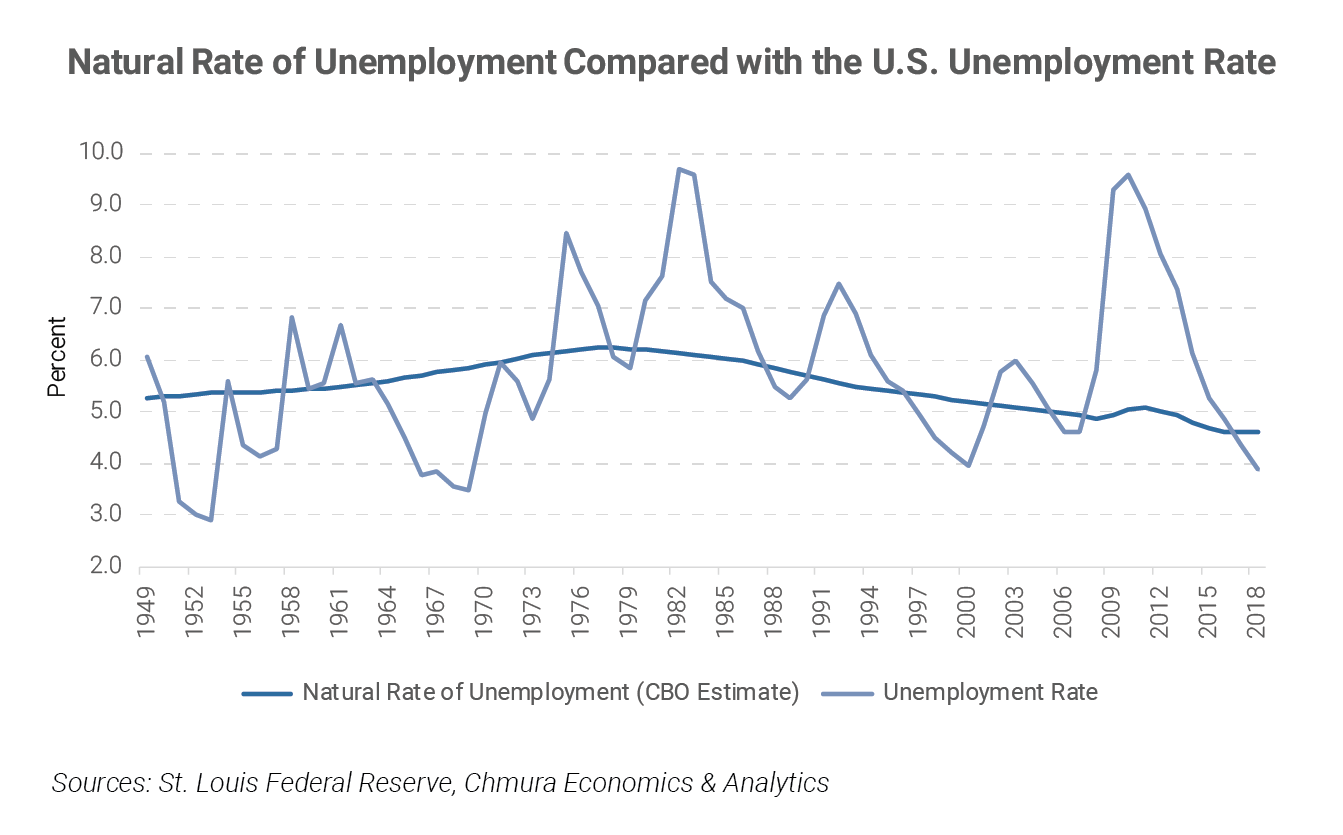

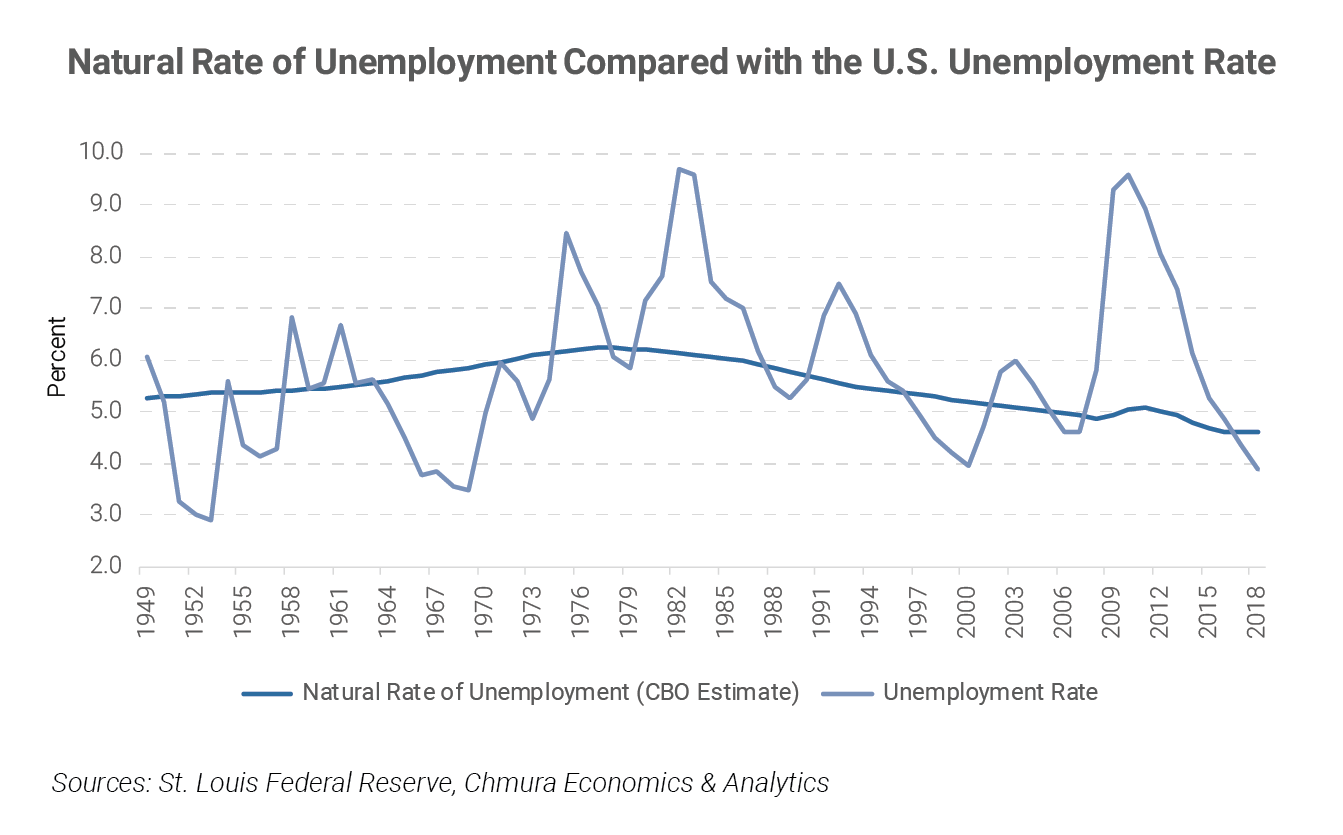

Currently, U.S. unemployment is below the Congressional Budget Office’s (CBO) estimated Natural Rate of Unemployment. However, since the CBO’s Natural Rate of Unemployment is only an estimate, it is not certain the economy has achieved full employment. Although there are ongoing arguments over whether the U.S. economy has or hasn’t reached full employment, the general consensus is that the current unemployment rate is at least nearing the level of “full employment.” If an economy reaches full employment, rising wages from the high labor demand would, theoretically, force employers to slow hiring. This effect may cause unemployment rates to rise or, at least, level off. However, when, or to what extent, unemployment rates may rise cannot be precisely determined by theory.

Historical unemployment trends may provide a greater awareness of how low unemployment rates may be expected to go and how long the rates can remain low. Post-WWII, the lowest average annual unemployment rate in the United States was 2.9% in 1953. The current unemployment rate (3.7%) is not all that far off. If the average unemployment rate decline of 0.74 percentage points per year since 2010 persists, we could be seeing record-low numbers in the not-too-distant future. However, this is extremely unlikely as the annual decline in the unemployment rate has consistently become smaller each year.

The length of time in which the unemployment rate remains low has varied historically. Unemployment in June was lower than it ever was since 1969, but this low rate is relatively new. Compared to unemployment rates in the 1950s and 1960s, a couple of years with unemployment below 5% isn’t anything out of the ordinary. However, since the mid-1970s, only the period from 1997-2001 had unemployment rates lower than 5% for longer than the current 33-month period. It is uncertain whether unemployment can remain this low like it did in the 1950s and 1960s or if this period of unemployment will be short-lived, much akin to the economic trends over the past few decades.

"The length of time in which the unemployment rate remains low has varied historically."

Another important aspect to consider is the Federal Reserve’s monetary policy. The Federal Reserve, with its dual mandate of maintaining stable inflation and full employment, will occasionally increase interest rates to stave off inflation. Such actions can lead to increased unemployment. The recent tightening cycle, which started in 2015, prompted the Federal Reserve to begin raising interest rates. Such increases have been small and deliberate, and unemployment rates have continued to decrease since then. Although there were calls for a sizeable increase in interest rates well before late 2015,[5] the Federal Reserve Board, under the leadership of then-Chair Janet Yellen, raised interest rates at a slow, incremental pace.[6] These increases may have slowed employment growth, but they clearly have not stopped the unemployment rate from declining. Presently, the target federal funds rate range remains between 2.25% and 2.5%, and the current belief is that the Federal Reserve will not be raising rates in the near future. Actually, given the relatively low inflation rates and recent comments made by Chair Powell, it is widely believed that the Federal Reserve will lower the federal funds target in 2019 and as early as this month. If this happens, it could help push the unemployment rate even lower.

Even though the Federal Reserve indicated it does not intend to increase interest rates, some models predict the unemployment rate will increase soon. The Federal Open Market Committee (FOMC) currently has estimated a modest 0.1 percentage point median annual increase in the unemployment rate over the next two years.[7]

Even with the possible interest rate cuts, signs of a slowing economy may be contributing to projected increases in the unemployment rate. While the overall economy is still running strong, durable goods orders, transportation orders, and new home sales all declined in May 2019. Investors clearly felt some unease around the end of May as major U.S. stock markets fell (markets rebounded in June, however). In addition, the Treasury yield curve, has been inverted for several weeks now; an inverted yield curve is historically an early warning sign of an upcoming recession.[8]

Aside from a slowing economy, it is also possible that the national unemployment rate will increase even if new jobs are created like we saw happen this June. This occurs when the workforce expands faster than new jobs are created.[9]

Ultimately, no one can say for sure exactly how low unemployment will go. With the current strong economy and a central bank that has indicated possible future interest rate cuts, the unemployment rate may fall below 3.5%. Nevertheless, uncertainty remains and, theoretically, the unemployment rate should begin to rise as the business cycle progresses.

[1] Frictional unemployment occurs when individuals lose their jobs or quit and begin the process of looking for a new job.

[2] Structural unemployment occurs when workers’ skillsets do not match the skillsets required for available job openings.

[3] Labor market equilibrium indicates that labor supply and demand are generally equal and there are no market forces causing the unemployment rate to shift.

[4] The CBO estimates the Natural Rate of Unemployment to be around 4.6%: https://fred.stlouisfed.org/series/NROU

[5] Calls to raise interest rates were primarily made by those concerned with possible inflation; however, inflation rates remained low despite the Federal Reserve not raising interest rates sooner.

[6] More about this debate can be found here: https://www.eurasiareview.com/19032019-the-fed-and-the-3-8-percent-unemployment-rate-oped/

[7] Source: https://fred.stlouisfed.org/series/UNRATEMD

[8] More on this can be found here: http://www.chmuraecon.com/blog/2019/april/08/economic-impact-time-will-tell-how-dangerous-this-simple-curve-is/?label=Richmond+Times+Dispatch+Articles

[9] See more here: https://www.forbes.com/sites/jackkelly/2019/07/05/the-june-jobs-report-is-great-news-for-the-job-market-economy-and-america/#31a6ad235e96