Workers Per Establishment: Structural Shifts in Manufacturing

By Former Chmura Staff |

Recently, we wrote about employment growth in manufacturing. Here, we look at manufacturing growth[1] in terms of workers per establishment.[2]

Prior to the recession, the average number of workers per manufacturing establishment had been declining. During the recession, the decline accelerated before recovering somewhat and then plateauing at an average of about 36 workers per establishment in 2012. Most manufacturing sub-sectors (three-digit NAICS[3] codes) followed the same general trend.

Some sub-sectors, however, departed from the norm. For example, the number of workers per establishment at beverage and tobacco product, computer and electronic product, and food manufacturing have been declining since 2006—and the recession appears to have had little effect on that trend. Conversely, the average establishment size in the sub-sectors of plastics and rubber products, transportation equipment, and wood product manufacturing has continued to grow steadily since the recession—this trend is not too surprising, since these industries typically rebound after a recession ends.

So, what accounts for these differences? A contributing factor is the aggregate effects of companies expanding or contracting in size due the economic cycle and their own business fortunes. A second factor is productivity—as manufacturers buy new equipment and implement new processes, they can often produce more product with less workers. Beyond these effects, however, some manufacturing industries may have also shifted structurally in their mix of smaller and larger establishments.

For example, let’s look at the number of establishments across different establishment-size groups in the beverage and tobacco manufacturing industry compared to those in the transportation equipment manufacturing industry.

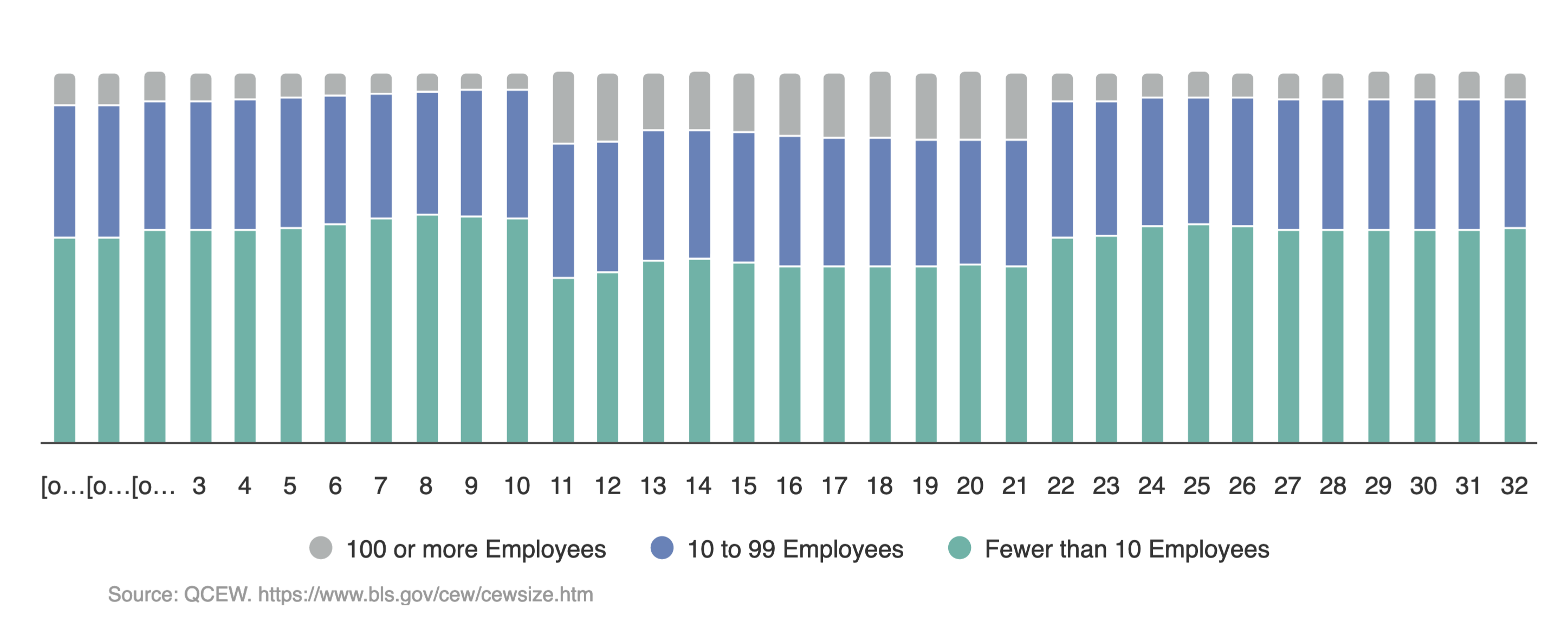

Percentage of Total Establishments by Establishment-Size Group, 2007-2017

The percentage of establishments in beverage and tobacco manufacturing with fewer than 10 employees increased from 55.1% in 2007 to 60.6% in 2017. During the same period, the percentage of establishments with 100 or more employees decreased from 9.0% to 4.7%.

While not quite as dramatic, transportation equipment manufacturing experienced the opposite effect—likely, in large part, due to the rebound after the recession when previously laid-off workers are called back to work. Between 2009 and 2017, the percentage of establishments in this industry with fewer than 10 employees decreased from 48.9% to 47.6%, while the percentage of establishments with 100 or more employees increased from 15.8% to 18.2%.

For manufacturing as a whole, the percentage of establishments with fewer than 10 employees increased from 55.0% to 59.0% between 2007 and 2010 before decreasing to 57.4% in 2012 and flattening thereafter. At the same time, the percentage of establishments with 100 or more employees decreased between 2007 and 2010 from 8.0% to 6.8.0% and then increased to plateau at 7.3% in 2012.

[1] Industry data in this analysis are compiled in JobsEQ and based on covered employment from the QCEW, published by the BLS.

[2] See the BLS’s definition of establishments: https://www.bls.gov/cew/cewfaq.htm#Q22.

[3] NAICS stands for the North American Industrial Classification System. NAICS codes begin at the two-digit level (referred to as “sectors”) and subdivide into industries down to six digits (three-digit codes shown in the table).

Subscribe to the Weekly Economic Update

Subscribe to the Weekly Economic Update and get news delivered straight to your inbox.